Antonio Mansilla

Supply Chain professional. Industrial Engineer. Like mountain climbing. www.antoniomansilla.com

Homepage: https://amansillalaguia.wordpress.com

Presentación Libro Rojo de la Logística

Posted in Logistics, Supply Chain on 04/10/2015

El pasado día 1 de Octubre de 2015, presentamos el Libro Rojo de la Logística, Publicado por Aecoc. Lo hemos escrito 20 amigos del FELOG de Caleruega (http://www.felogdecaleruega.com).

El pasado día 1 de Octubre de 2015, presentamos el Libro Rojo de la Logística, Publicado por Aecoc. Lo hemos escrito 20 amigos del FELOG de Caleruega (http://www.felogdecaleruega.com).

Nuestro único propósito es compartir nuestras experiencias, que pudieran ser útiles a otros compañeros del sector, y contribuir a divulgar el conocimiento logístico y de operaciones.

El libro consta de 50 capítulos organizados por áreas dentro de Supply Chain (Planificación, aprovisionamiento, Fabricación, Distribución, Estrategia, etc). El lector puede seleccionar aquel tema que más le interesa en ese momento y leer solo los capítulos relacionados. Allí encontrará consejos prácticos, que nosotros mismos hemos puesto en marcha durante nuestras carreras profesionales. No es un libro teórico, pero si documentado con rigor.

Yo he escrito dos capítulos: “Fabricación como eslabón en la cadena de suministro” y “Agilidad en la cadena de suministro”. De este ultimo escribí un post que podéis encontrar en mi blog en la versión en inglés.

En mi opinión, cualquier profesional que trabaje en operaciones, debería conocer como se integran todos los eslabones de la cadena de suministro, pues los principales beneficios se consiguen cuando las decisiones se toman considerando en impacto en toda la Supply Chain. Este libro puede ayudar mucho a dar esa visión completa, de principio a fin.

Entre todos los autores se acumulan más de 500 años de experiencia trabajando en logística, en empresas de primer nivel. Aquí os dejo una foto de parte de los autores en el acto de presentación del libro.

El libro ya se puede encontrar en Amazon (Libro Rojo de la Logistica). Espero que lo disfrutéis.

Nota: Por supuesto, comentarios, criticas, sugerencias, son bienvenidas.

Presentation Alimarket – (Spanish)

Posted in Agility, Logistics, Supply Chain on 22/05/2014

Este Jueves 22 de Mayo presento en el congreso de Logística de Gran Consumo organizado por Alimarket.

Adjunto os dejo un vídeo de una entrevista que me hicieron previa al congreso, donde explico de qué voy a hablar.

Es mi opinión, pero comentarios son bienvenidos.

Spain will invest 8 billion Euros in a new Strategy for Logistics Efficiency

Posted in Economy, Education, Logistics, Supporting Spain on 29/11/2013

Spain will invest €8 billion to implement it new Logistics and Supply Chain strategy. Logistics costs account for 7% to 14% of product price and the sector represents 5,5% of Spanish GDP.Therefore, improving this key part of the economy will improve overall competitiveness of Spain.

This initiative reflects the acknowledgment of the importance Logistics.

The document (click on the image to download) starts with the European orientation and positioning of Spain. Then analyses the regulatory framework and status of demand, offer and infrastructure. It sets principles and directions and finally defines 18 specific actions, that you can find in Chapter 13.

The actions that I like the most are:

3.- Liberalization of rail transportation

4.- Education in Supply Chain

8.- Evaluate potential increase of max authorized weight and vehicle dimension for road transport

18.- Improve connectivity of ports with their hinterland

Do you thing others are more important? Please share your point of view.

Agile corporations require agile supply chains

Posted in Agility, competivitive advantage, Management, Supply Chain on 05/11/2013

Consumer Goods industries have embraced lean methodology to progress. However, global markets are more volatile and there is a need to go beyond. In this post I present agility as the proper respond for those companies that want to exploit the opportunities that appear in this new rapid changing world.

Idea in brief:

Gaining agility in the supply chain operations is clearly a need nowadays. I will mention several ways and tactics to achieve it, but what it is really important is that companies use it to gain competitive advantage. It has to be in the company culture and has to be embedded in the strategy set by top executives. Then, each firm has to find the best way to execute it, according to its own business reality.

You can download the post here: Supply Chain Agility – June 2013-English

1. What´s agility?

The capability to adapt quickly to uncontrolled changes in the environment. In the business world, it can be defined as the capacity to identify and capture opportunities more quickly than competitors do.

The highest level of agility is that of corporations that are able to change the rules of the game in the industry they are in, or even create completely new ones (Strategic Agility). Google is an example. Other companies succeed entering in new businesses as the opportunity to make benefit in each of them changes. (Portfolio Agilty). This requires the courage to shift resources quickly and effectively out of the less promising business areas into more attractive ones. Operational Agility involves exploiting opportunities within a focus business model (Zara-Inditex). The support of an agile Supply Chain is essential and it is in this last type of agility where we are going to focus in this article.

2. Today more needed than ever.

The environment and business conditions have never been stable. In fact, different industries are exposed to changes at more or less rapid pace, which determines the “clock speed” of that industry (i.e mobile telecoms vs commercial aircraft manufacturing). What it is changing is the speed and depth of those changes. A very promising and profitable business can vanish in two years (i.e. paper photography and Kodak).

Martin Christopher and the Cranfield University have developed and index in an attempt to quantify the level of volatility and its evolution: “The Supply Chain Volatility index”. They have selected a set of indicators and prices of reference, of which data exist for the last forty, and combine them to analyze the evolution of their covariance factor.

Key conclusion is that the level of stability has been relatively high, only disrupted by isolated events or shock crisis. However, since 2008 this has fundamentally changed, and we are entering a period of increased turbulence.

According to the concept of “Strategic Leverage”, (Ph. Milind Lele, Chicago Booth), the Opportunitiy to materialize profit in a given business is equal to the Capability (internal firm skills and resources) x Leverage (external market situation that has potential). What is happening now is that the “leverage” is changing faster and faster or even disappearing. Example: Technological changes made paper photography irrelevant for consumers and, although Kodak had an excellent capability to operate in that business, the “leverage” vanished. Kodak was not agile enough and bankrupted.

But at the same time new areas of opportunity arise, that will last short before they mature and reach a level of rivalry that will make them unprofitable. Those companies agile enough to develop capabilities that fit the new opportunities, before competitors do, will maximize profits.

3. Agility in Supply Chain.

Companies that manufacture or distribute products and capital goods need a strong supply chain that accompanies, support and maximize the organizational agility of the corporation as a whole. It is within the operational agility where the supply chain function can contribute well.

The first concept we tend to think of is Demand Agility, how quick we can respond to sudden changes in demand, maintaining high service levels. Of vital importance is also Product Cycle Agility, or how quickly we can develop, make and launch breakthrough innovation, while discontinue declining products without incurring in obsolescence write-off or significant loses of sales. There exist also a trend to adapt products and services to the specific needs of certain customers and channels, which leads to the concept of Customization Agility. All these types of responses can be done with the current network and can be grouped as Dynamic Flexibility.

This should be a first step. But those companies that want to be competitive for many years have to go beyond. Demographic, politic, economic and technological changes can make that the center of gravity of our demand moves very quickly. Radical changes in oil prices, raw material, currency exchange, or more protectionist regulations can make producing or distributing in certain countries unprofitable versus other options. Flagship products and manufacturing processes can become obsolete within months. Shifts in consumer expectations or in the structure of the distribution channels may require a completely different go to market strategy. Here Structural Flexibility plays a relevant role. Let´s say that 80% of the European demand for a company moves from France to Russia, How long would it take to that company to reduce volume in factories and distribution centers in France and have them 100% operative in Russia? Furthermore, how long would it take to top management even to consider it and make the decision? It will depend a lot on how well prepared is that firm to do it minimizing risks. And also its cost split between fix and variable, level of outsourcing, if it has strong processes that allow them to continue operating while these transitions are taking place. Talent and organization will be key: the less management layers between top executives and front line managers, the easier and faster the process will be.

4. How to gain agility in Supply Chain.

I am going to give some tips, as examples, and only with the main objective of making us reflect on the subject. The actual application to a specific company will depend on its particular situation.

A) Organization Structure

If, i.e., between the European Supply Chain VP and the manager of the single Italian distribution center there are six layers of management, agility is going to be difficult. Companies with a flatter organization structure enjoy a much better flow of information and faster decision making.

Besides, in many multinationals supply chain is no longer within the responsibility of the country commercial organization and solid reporting lines only join at top regional level or even the global CEO. That is often very efficient operationally and to maintain status quo, but there is a high risk of losing the connection with the changing commercial reality. Proper forums, committees and cross functional task forces should be established to maintain a fluid relationship between Sales and Operations. Well managed S&OP processes greatly help. And roles like the supply chain liaison for a commercial business unit.

B) Lead time reduction.

From my point of view is the biggest area of opportunity. Strong effort has to be put in making cycle time as closer as possible to process time. A key enabler is the reduction of line changeover time and set up time between two production runs. It usually requires line cleaning, packing machine adjustment and even tooling replacement. If this time is very long, we will lose much production capacity and the tendency will be to make as longer batches as possible, deviating from our agility objective. Possible solutions are the installation of automated CIP equipment (clean in place), pre-preparation of the tooling to change and anticipate to the changeover time as many activities as possible. With the right process we can achieve really quick setups. I recall how the industrial director of a Coca-cola bottling plant called the line changeover: PIT STOP, as in Formula 1, clearly communicating what he wanted it to be.

Other key elements are transportation lead time and minimum economic order quantity. In general slower transportation modes are cheaper, but it is here where we have to balance the extra cost with the advantage of a rapid response to demand changes. Quantify the latest is often difficult and the cheapest option is chosen. Other companies, like Inditex and most High Tech’s make a very intensive use of airfreight. Another way to reduce minimum order quantities without incurring in extra cost is horizontal collaboration between manufacturers.

C) Minimum stock-holding points and location of distribution centers.

It is much easier to respond to sudden changes in demand with few inventory locations. A multi-market distribution center can balance its inventory as the demand of each market if fluctuating, improving product availability. If we had one DC for each country/market we may end up with the wrong quantity of stock in the wrong place, and not being able to respond to volatility. With this principle in mind, Kellogg Company changed the way to supply and distribute to the Portuguese market. There was a distributor DC, north Lisbon, which was supplied directly from factories in Manchester (UK), Bremen (Germany) and Valls (Spain). At the same time, all products were shared with Spanish market (multilingual packs). Early 2011 it was decided to supply all products from the Spain distribution center, which was supplied from the above mentioned plants. Transportation cost slightly increased, but the delivery lead time for most products was reduced from 15 to 5 days. The Euro crisis in 2011 and 2012 brought a situation of huge volatility and forecast accuracy dropped from 40% to 32% (worst in the company by far). However service level (OTIF in cases) increased from 92% to 96% (and continued improving afterwards). Incremental sales, thanks to these improvements, clearly outweighed the additional investment in transportation.

D) Postponement

Another strategy that drives efficiency and agility is the planned used of inventories with a decoupling point at the latest possible step of the process, until where we can work with common SKU´s and beyond which differentiation is required and complexity soars (postponement). I.e.: It is possible to manufacture just one product for global markets, keep it without market label and postpone the labeling process until the very last moment, when the demands of the different markets are more certain.

E) Elimination of bad complexity

Supply Chain, by definition, has to manage the complexity generated by our sales and marketing colleagues, and market dynamics. But this that is complicating our life can be essential for the company growth and part of the competitive advantage. The key is to detect and dissect which part of the complexity is not adding value, that it exists just due to lack of internal coordination or because there has not been enough simplification focus. A clear example that applies to most companies the size of line. What should be the right assortment offering? What is the value added by the tail? A way to fight non-productive sku proliferation is to agree a set of “Rules of the Road” that defines certain volume and profitability hurdles new products must meet before launching and a solid process, approved by top management, to discontinue them easily. Consider also the standardization of components, with as many as possible common ones for the manufacturing of different final products. It does not reduce a carried offering to consumers but it does a lot to the number of internal codes. That is what the automobile industry is doing, with big holdings grouping several car brands. They began sharing the same frame for cars of different brands under the same group. Now they go beyond than and they have standardized the joint positions and fixing mechanisms of major sub-structures, like frame and engine. Therefore with fewer engines and frames in the group they are able to offer more options to consumers.

D) Fix assets investment decisions

One the factors that can limit agility the most is to have done big investment in assets with long depreciation periods. Here, not following basis principles like NPV (net present value) or reasonable IRR (internal return rates) of the investment, justified as “strategic project” is very risky. The payback period must be taken into account. Not always automating until the last process is the best solution. Often “semi-automation” serves a very good balance between excellent operating costs and flexibility to adapt the installation to changing needs. The same apply to long rent facility contracts. Obviously you can get better prices if you sign for many years, but… when the conditions have changed, how much does the possibility to change location worth?

E) Outsourcing decisions: “Buy” or “Make”

They are of vital importance. Just take the case of IBM when they decided to outsource the operating systems and microprocessor of their new PC. But doing everything “in house” can be very slow too and you risk not taking advantage of the capabilities of your vendors and suppliers. The key is to choose carefully which activities to outsource, the type of control kept on them and negotiating power swifts these decisions create. When done properly, outsourcing is a very good way to gain agility, not only to enter into new activities but also to have an easier exit.

5. Agile vs Lean

There is much literature that helps us to identify when to use an agile or lean approach. But , both philosophies are not incompatible and complement each other very well. It can come from a misconception of the lean methodology, identifying it with the pure reduction of operating costs. In fact, it fundamental principles are: a) elimination of all waste that does not add value in the eyes of the customer and b) empower front line employees to drive continuous improvement. What creates value in the eyes of a customer is not a static concept. Therefore being able to sense and detect what our customers value now and translate it into new products and processes quickly is at the heart of both methodologies. Good front line employees, equipped with solid lean concepts and behaviors, will be of invaluable help to reassign resources quickly to the areas where more profitable opportunities arise.

6. Agile corporations require agile supply chain.

If we consider which are the most agile supply chains in the industry, it is easy to observe that they almost always respond to a business model need, at a higher level company strategy. Decisions often increase the cost of manufacturing or distribution versus other options, but they put the company in a scenario or superior competitiveness, they add value which consumers a ready to pay for. Sure Inditex could deploy its products to its worldwide network of shops cheaper that using airfreight. It is key to understand that this agile supply chain is designed to serve a very specific business model: have the cloth that consumers like available in each shop (due to super-fast replenishment).

Establishing a really agile operation will require to make tough decisions, with the support of the top executives. Therefore, it will be very difficult this to happen if it is not seen as a priority to drive the broader strategy of the company. It is the responsibility of the supply chain professionals to sense and detect how to create commercial value and demonstrate that operating with agility will contribute towards sales increases and profitability.

Spain Economy will come back – The mediterranean Rim Turmoil

Posted in Economy, Management, Supporting Spain on 17/08/2013

On August 13th I received another report on International Political Economy from my profesor at the Chicago Business School, Marvin Zonis. Always excellent and touching the real important matters. This time about South Europe Countries Economy. I have to admit that I was badly hurted by what I read.

Here I leave you the report: TheMediterraneanRimInTurmoil8-13-13

The perspective given about Spain in this report in very pessimistic. It is true economy is bad, but I live every day here and do not see the Apocalyptic Scenario shown in this report.

There are some good important things that remain stable:

1.- Institutions are solid.

– Even some corruption news about the party in government confirm it. On the contrary, that wouldn´t have reached the press and further investigations (Watergate type)

2.- The Spaniard “mentality” is quickly changing

– Productivity increases: people working harder to secure the jobs they have (Labour cost per unit index show that clearly).

– Public state workers have also increasing productivity and flexibility

– Last labor reform has greatly contributed to this.

3.- Good infrastructures

Spain invested here a lot of the benefits of the good times, and they remain.

4.- Exports growing (contrary to what it is said in the report): I add here Eurostat data, (and 2013 will be even much better)

5.- Credit (there is money – but lack of trust => no liquidity)

Big banks have big inflows of money but they are very reluctant to lend due to the high risk they still see in the economy.

We started the crisis with more than 300 billion of bad building loans, and it is taking a lot of time/effort to digest it. But we do not want to default, or exit the Euro, which perhaps helps in the short term. But we would not be perceive as a serious country in the long term by the international community. And that would be worst.

From all the information I receive, I believe that 2012 was really the “disastrous year”, and that it set a floor.

And while the recovery is going to be very slow for still 2 years, I am confident Spain will come back.

Antonio Mansilla

Supply Chain debe crear Valor Comercial

Posted in Supply Chain on 07/03/2012

Últimamente me han preguntado ¿qué es lo más importante para Supply Chain? ¿el coste? ¿inventarios bajos? ¿buen servicio? ¿calidad?¿flexibilidad?…

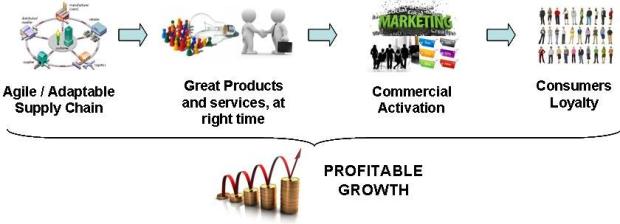

En mi opinión, lo que todo profesional de Supply Chain tiene que preguntarse cada día es: ¿Cómo puedo crear valor comercial para mi compañía? ¿Qué puedo hacer para que se venda más? ¿Cómo voy a enamorar a los consumidores? ¿Qué productos y servicios irresistibles les puedo ofrecer?

Y para eso la función de Supply Chain tiene que ser muy ágil y dinámica. Así podrá estar pendiente de lo que buscan los consumidores y creará productos y servicios geniales antes que los competidores. Marketing y Ventas nos tendrán como aliados para activarlos comercialmente. Y estaremos ofreciendo a los consumidores aquello que demandan cuando y donde quieren. Eso genera clientes fieles que permiten a los negocios crecer de forma rentable.

Calidad: Hay una calidad mínima que es imprescindible dar, pero a partir de ahí que determinar aquel nivel que el cliente realmente valora, y no es fijo.

Costes: reducir un 5% el coste de fabricación de un producto que ya no quiere nadie (por que han nacido productos sustitutivos más interesantes) puede ser inútil. Sin embargo, permitir que el equipo de investigación y desarrollo pueda probar en producción una innovación 6 meses antes (porque seamos muy ágiles activando y desactivando turnos, por ejemplo) puede aportar mucho más valor.

Inventarios bajos: En principio siempre es bueno. Pero si entramos en una etapa de alta volatilidad de la demanda o el equipo comercial está realizando una campaña promocional en una marca, hay que saberlo y puede ser importante aumentar los stocks de seguridad “de esa marca”, no de todo.

Servicio: Por supuesto, pero ¿a qué coste? ¿Es nuestra oferta de servicio competitiva? Puedo llegar siempre a tiempo si comprometo un plazo de entrega enorme, pero puedo estar perdiendo pedidos frente a otros competidores más agresivos.

Los profesionales de Supply Chain no podemos vivir en nuestro mundillo de máquinas, sistemas, productividades, costes de trasporte, tiempos de ciclo, capacidad de producción o almacenaje, etc. Tenemos bajo nuestra responsabilidad la mayoría de los activos fijos de la compañía y gran parte del coste. Debemos conocer cómo ven los consumidores nuestros productos y servicios, los retos a los que se enfrentan nuestros compañeros del área comercial y que planes tiene. Solo así podremos priorizar adecuadamente en el día a día y poner nuestra inteligencia a trabajar en aquello que más valor genere.

Y como los mercados cambian cada vez más rápido, sólo podremos responder si construimos operaciones ágiles y adaptables, … pero esto será tema de otro post.

Productivity = Technology + Smart People + Innovation + Labour Flexiblity

Posted in Management, Supply Chain on 23/12/2011

Achieving increasing productivity is essential to Supply Chain in any organization. To do it in a sustainable way we must have (to my understanding):

1.- State of the Art Technology

Every operation has to search what tools and technologies available in the market, and choose which are more suitable in any case. ROI (return on investment) rules apply always. It is not about having a fully automated warehouse with a 20 year payback. It is about smart and customized automation. In my opinions is better to start a multiyear journey into higher tech, than a big-bang approach.

2.- Smart people capable of making the most of technology

Quite often organization invest in a new ERP or very automated distribution center or factory (because they see it as on-time investment) but are reluctant to hire and train several engineers or super users to make the most of that investment. I guess the reason is because that is an on-going cost in the operating budgets.

Clearly is a mistake: Good professional, well-trained and with enough time to invest in the fine tuning of systems and equipments can really make the difference, and leverage company investment for better returns.

3.- Constant breakthrough Innovation.

Once an operation has the basics, it will be at similar competitive level as it peers. To really have a competitive advantage from operations, you should try really new processes that can create true differentiated product and services. But competitors will do it too. So the race never ends. Those who can develop their innovation at higher speed WIN.

4.- Labour Flexibility.

This is much more than cheap redundancy cost.

It is about possibility to have the right quantity and quality of human resources in each process/activity/department all the time. Some ideas that helps: – High qualification at every level, makes people more polyvalent and can fit were the need is.- Establish good talent management process, where people issues are address right on time, and high potentials early identified.- Mobility (functional and physical), is empowered and supported.

The combination of these 4 elements is the base for consistent higher and higher productivity, for operations, companies, administrations and countries. Easy to say, more difficult to do.Antonio

UNO- La organización definitiva de la Logística en España

Posted in Economy, Supply Chain on 04/12/2011

Esta semana asistí al primer encuentro de la organización empresarial UNO.

Surge desde la antigua LOGICA e integra a algunas otras organizaciones del sector. Esta vez sí parece que es la organización de va a defender los intereses del sector con una sola voz en las instituciones y frente a la administración. Su presidente: Gonzalo Sanz.

Resumiré los temas que se hablaron:

1.- Presentación UNO y datos del sector logístico

De momento lo forman 400 socios que facturan 10.000millones y generan 100.000 eempleados. Están las principales empresas Transportistas y Operadores logisticos (DHL, ID, FCC,…) No está la gran Distribución (Mercadona, Eroski,..) ni Fabricantes (Kelloggs, Danone, Pascual,..)

Este sector representa 5% del PIB Español y tiene 180.000 empleados. Casi nada.

Pedirán la privaticación de competidores públicos y que se compita en igualdad de condiciones, es decir, que nadie tenga ventaja por no cumplir la legislación. Se pretende mejorar también la rentabilidad de un setor, que al estar muy atomizado, tiene margenes muy reducidos.

2.- Jordi Sevilla se pone en el papel de Rajoy (¿? no me pregunteis…)

Dice que el principal reto en 2012 es la refinaciación de la deuda (pública y privada) Debemos 1,5billones de €. Este año hay que refinanciar 350kM€ y llegar al 4,4% de deficit.

Atención a lo que supone: Todo lo recortado hasta ahora por el gobierno de Zapatero es de 15.000M€. El año que viene hay que reducir el doble 30.000M€ (imaginemos la situación)

Cuando Zapatero hizo el compromiso de déficit se conto con crecimiento en 2012, pero España crecerá menos que esta año (0-0,3%).

En su opinión hay que “reformar” los gastos frente a recortarlos (¿?). Y en concreto hacer:

1) Bajar cotizaciones sociales (en lugar de bajar salarios, que afectan a la demanda).

2) Resolver la falta de crédito: crear banco malo

3) Política de ajuste del déficit que no sea el gasto público. Cortar los que se debe cortar, no lo más fácil.

4) Apoyar sectores claves: Según él, Construcción, Automóvil, Alimentación, Transporte y Turismo.

3.- Luego se empezó un debate sobre el LIDERAZGO, y se habló de todo:

Para Javier Campo (Presidente AECOC): “visionar a donde quieres ir y adherir a otros al proyecto”. Lider es el que dinamiza el sector, lo hace crecer, innova, (no el de mayor cuota).

Para Juan Pablo Lázaro hay que tomar decisiones:

– La empresas medianas y pequeñas no tiene crédito, reforma sector financiero YA.

– Reforma laboral definitiva de una vez.

– Eliminar trabas y barreras administrativas a la creacion de empresas.

Según Jose Maria Fidalgo una reforma laboral sola no va a crear empleo. La solucion vendrá a nivel mundial y la UE tiene que aclararse en los proximos 5 años como maximo.

Luego se empezó el tenerno debate sobre CARRETERA-FERROCARRIL. Se han aprobado los Corredores del Mediterraneo por ferrocarril, a 20 años. La pregunta es ¿quien lo pide? Es un 50% mas caro nadie lo quiere ¿porque se hace si aqui nadie lo pide? ¿sobra dinero?

El debate no fué nada de otro mundo, pero el nacimiento de UNO si parece importante.

Antonio Mansilla

Chief Supply Chain Officer forum en Amberes

Posted in Supply Chain on 27/11/2011

Esta semana tuve la oportunidad de participar como ponente en el CSCO forum, en Antwerp (Amberes)

Lo mejor fue conocer a un muy reducido grupo de españoles, poniendo una pica en Flandes: Ernesto Orueta (Dir logistica no alimentación de Eroski), Alejandro Uzquiano (Dir. Log Bonduelle), Jose Carlos Castellanos (Dir. Log de Legrand) y Marcos Casellanos (Representante de PromoMadrid).

La audiencia era de gran nivel (responsables europeros y mundiales de Supply Chain de grandes compañías). Los temas tratados fueron:

1.- Supply Chain resilience.

Como de resistentes son nuestras cadenas de suministros frente a fallos serios en uno de sus eslabones. Tema crítico para todos. Me sorprendió lo preocupados que estaban nuestros colegas del sector tecnológico porque siguiera funcionando la logística inversa. En mi caso, expliqué que la clave es tener redundancia en fuentes de suministros, mismos procesos en varias plantas y centros de distribución que puedan suministrar a otros mercados en corto plazo (aun a expensas de un mayor coste de transporte temporalmente).

Hubo consenso en que tener una visibilidad total de cadena de suministro es crítico para poder tomar decisiones rápidas y coordinadas al mas alto nivel.

2.- Become a Supply Chain CFO.

Es fundamental un buen conocimiento financiero para poder desarrollar una carrera en Supply Chain, y en el día a día que la coordinación con nuestros “Supply Chain financial business partners” sea muy fluída. A la vista de lo oido, creo que he tenido más suerte que ellos con los financieros que me han ayudado a controlar las operaciones bajo mi responsabilidad.

Tambien se habló de KPI´s (pocos por favor…, solo los críticos)

3.- Sales and Operations Planning

Se debatió sobre si es muy importante un buen sistema informático que apoye el procesos y si es necesaria una organización ad-hoc para mantenerlo. Yo opiné que no, con hojas excel puede funcionar, pero no sin el compromiso del área comercial y la alta dirección.

Me gustó el comentario del Dir. SC de Nestlé Waters: “hemos roto con el principio de un solo número (finanzas, ventas, supply chain,..) y lo que buscamos son corredores con aproximación razonable”. Mi experiencia apoya este comentario.

4.- Sustainable Supply Chains: Where are we really?

Muy buena presentación del presidente de SC Europeo de Philips: No se habló solo de medio ambiente, sino tambien de contratación responsable (controlar que los subcontratistas no utilicen niños, por ejempo o jornadas inhumanas). Debate centrado en la huella de carbono. Mensaje: lo primero medir, para poder mejorar y después informar y vender.

5.- Horizontal Colaboration

Se habla mucho de compartir recursos logísticos entre compañias con clientes comunes, en el mismo sector e incluso entre competidores. Hay barreras de las leyes de defensa de la competencia, pero se están reduciendo.

La principal barrera es encontrar el socio adecuado y definir hasta donde se quiere llegar en la integración para aportar el máximo valor. Según McKinsey, la reducción más importante está en los costes indirectos cuando se llega a una integración estratégica. Pero…¿quién se arriesga a llegar tan lejos en un primer paso? Hicimos un juego de simulación donde todos los grupos nos fuimos a la máxima integración, obteniendo los mayores ahorros para todos los actores (fabricantes y operadores). En la realidad he visto pocos pasos y mucho más limitados y prudentes.

6.- Supply Chain in emerging markets

Excelente presentación de Robert Vallender, Head of Physical Logistics – Corporate Supply Chain of Nestle.

Me quede con: Empezar con socios locales, definir desde la central el marco de referencia (Valores, cumplimiento de las legislaciones, control de las inversiones de capital,..) y dejar hacer a los que están sobre el terreno. El algunos paises como China, lleva años ganarse la confianza de las autoridades locales. No hacer una implantación masiva nada más llegar, sino utilizar co-manufacturers, co-packers, distribuidores locales. Y lo más importante: no explotar el mercado local. Si se tiene una voluntad de permanencia a largo plazo hay que aportar a la sociedad del área donde pretendemos entrar.

Más que entrar en los detalles tratados, el objetivo de este blog es indicar los temas que ahora son más importantes para los directores de Supply Chain de las grandes compañías europeas.

Antono Mansilla

FELOG – Foro de expertos logísticos – ¿quién forma a los profesionales que necesitamos?

Posted in Supply Chain on 23/10/2011

Esta semana tuve la oportunidad de participar en el FELOG – Foro de expertos logísticos de Caleruega.

En él participan los máximos responsables de Supply Chain (cadena de suministro) de grandes empresas españolas y multinacionales, operadores logísticos y de transportes y escuelas de negocios.

Como es norma en este foro se discutieron varios temas referente a la actualidad de nuestro sector, pero sobretodo se toco uno que me interesó muchisimo. ¿Cuan es la formación de base que deben recibir los profesionales del sector? ¿De donde vendrán las nuevas generaciones que liderarán esta función, absolutamente clave en todo tipo de emrpesas?

Resumiré el debate en tres conclusiones:

1.- Este sector es poco conocido.

Supply Chain existe en todas las empresas, pero casi ninguno de nuestro jovenes inicia una carrera universitaria o profesional con el deseo de formarse para trabajar en el. Reconocemos nuestra responsabilidad en que esto sea así.

2.- No hay formación reglada.

No existe una asignatura como tal en las carreras de ADE ó ingenierías que toquen esta función. Los profesionales son formados en las empresas, en su gran mayoría. Una excepción notable es el Grado de Ciencias del Transporte y Logística que ha creado la Universidad Camilo José Cela. Todavía no ha terminado la primera promoción y ya tienen empleo el 100% de los alumnos. Deberemos influir para no se quede todo en una buena excepción.

3.- Publicaremos desde el foro un Articulo para explicar qué tipo de profesinales serán necesarios en este sector.